Intelligent Supply Chain Planning and Control

The Right Time

and Control

Demand Planning

Supply Planning

Sales & Operations

Planning

Business Intelligence

End-to-end Supply Planning

& Business Intelligence

We are a technology company offering supply planning and

parcel spend management solutions to businesses of all sizes in a variety of industries. And because each client has specific needs and requirements, we don’t offer a one-size-fits-all approach. Our solutions are tailor-made to your needs.

Solutions for industries spanning the supply chain and the globe:

Demand Planning

Supply Planning

Sales and Operations Planning

Business Intelligence

Demand Planning

-

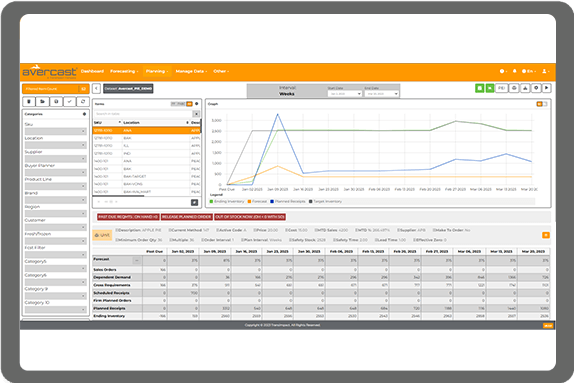

Demand PlanningDemand Planning Software allows companies like yours to forecast upcoming demand for a product and plan inventory accordingly. Sometimes referred to as business forecasting software, this solution helps your company avoid unproductive stocking. Using demand forecasting for your supply chain, you can reduce inventory costs, and, in turn deliver excellent customer satisfaction.

Supply Planning

-

Supply PlanningOur demand planning and forecasting software products are powered by 280+ advanced statistical algorithms and utilize ML (machine learning). Robust and accurate, Avercast products are easy to use and fast to implement, letting you identify opportunities and risks to make changes across the organization that lead to increased margins and improved EBITDA.

Sales and Operations Planning

-

Sales and Operations PlanningAlways know what inventory you need with Sales and Operations Planning Software. Plan for “what if” scenarios and optimize your demand planning. Build customized reports that fit your business needs. Align your sales and Operations with real-time updates using S&OP software.

Business Intelligence

-

Business IntelligencePowerful Business Intelligence analytics allow you to merge disparate systems, combining data and eliminating data silos for maximum efficiency and visibility. In just three to five clicks, we will help you pinpoint financial KPIs, EBITDA, operational and expense reporting, and streamline your data tracking and management.

Planning and profitability technology solutions that provide

automation and visibility to improve profit and enable growth.

automation and visibility to improve profit and enable growth.

What value does Avercast brings to your business?

Improves productivity

Avercast’s software automates demand planning and forecasting, which reduces manual intervention, reduces lead time, and enhances productivity.

Avercast’s software automates demand planning and forecasting, which reduces manual intervention, reduces lead time, and enhances productivity.

Meticulous forecasting

With more than 280 algorithms, our Demand Forecasting Software allows you to forecast precisely. The algorithms also help you comprehend your inventory effectively.

With more than 280 algorithms, our Demand Forecasting Software allows you to forecast precisely. The algorithms also help you comprehend your inventory effectively.

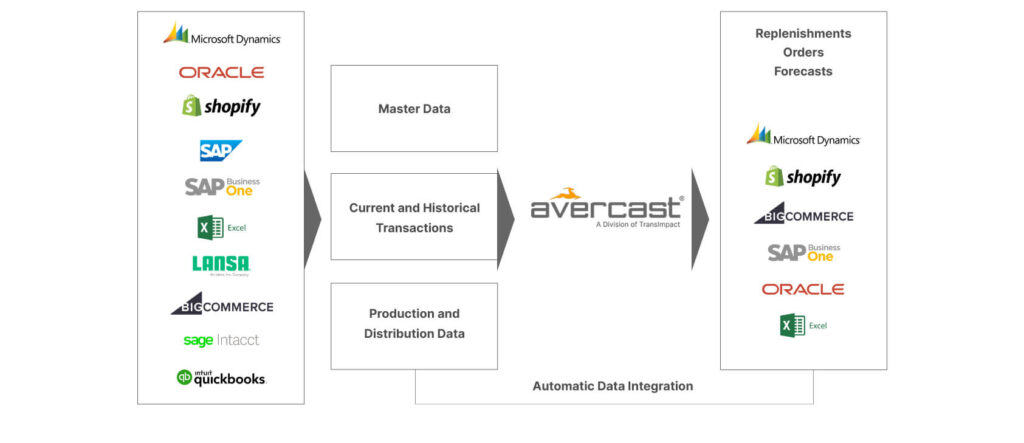

Integrates easily

One of the critical benefits of the software is that it combines with all major ERPs effortlessly, making it easier for you to operate and get results.

One of the critical benefits of the software is that it combines with all major ERPs effortlessly, making it easier for you to operate and get results.

What-If analysis

Customer demands depend primarily on external factors. It is crucial to plan for all possible scenarios. Our intelligent software simulates the situation and helps you prepare for it.

Customer demands depend primarily on external factors. It is crucial to plan for all possible scenarios. Our intelligent software simulates the situation and helps you prepare for it.

Potential opportunities

The software assists you in identifying untapped customer groups, magnifying the possibility of acquiring new consumers and thus increasing your market presence.

The software assists you in identifying untapped customer groups, magnifying the possibility of acquiring new consumers and thus increasing your market presence.

Customized solutions

We are always committed to providing you with world-class service and devising software to meet your needs.

We are always committed to providing you with world-class service and devising software to meet your needs.

Our pioneering software integrates with all ERPs

Accurate, Robust, Easy-to-use

|

Pitfalls To Avoid

|

The Avercast Advantage

|

|

Inaccurate forecasts based on sets of complicated

formulas and incomprehensible data.

|

Up to 99% accurate forecasting backed up by a set of proven algorithms

Up to 99% accurate forecasting backed up by a set of proven algorithms

|

|

No guarantee of data privacy. Everyone can

access the data

|

Specific permissions to disallow data accessibility for everyone

Specific permissions to disallow data accessibility for everyone

|

|

An eyebrow raising certainty of data security and

no revenue enhancement

|

Effortless data security and better product availability ensure 5% revenue enhancement

Effortless data security and better product availability ensure 5% revenue enhancement

|

|

High turnaround times, the looming threat of losing potential sales

|

With 280+ forecasting algorithms, turnaround times is in minutes

With 280+ forecasting algorithms, turnaround times is in minutes

|

|

A potentially vulnerable situation due to no

backup of data

|

Automatic data backup makes abrupt closure harmless

Automatic data backup makes abrupt closure harmless

|

|

The tedious task of manually inputting data

into the sheets

|

Automatically fetches data from ERPs and predicts for up to 60 months in future

Automatically fetches data from ERPs and predicts for up to 60 months in future

|

|

Integrates only with one data source

|

Integrates fully with different data warehouses and ERPs

Integrates fully with different data warehouses and ERPs

|

|

With the change to the windows version,

issues begin to rise

|

Quickly and automatically integrates with new windows versions

Quickly and automatically integrates with new windows versions

|

|

Only people with skills and higher knowledge

can work efficiently

|

No unique skills are required, and it is easy to operate

No unique skills are required, and it is easy to operateand user-friendly |

Customer Reviews

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

||||

Previous

Next